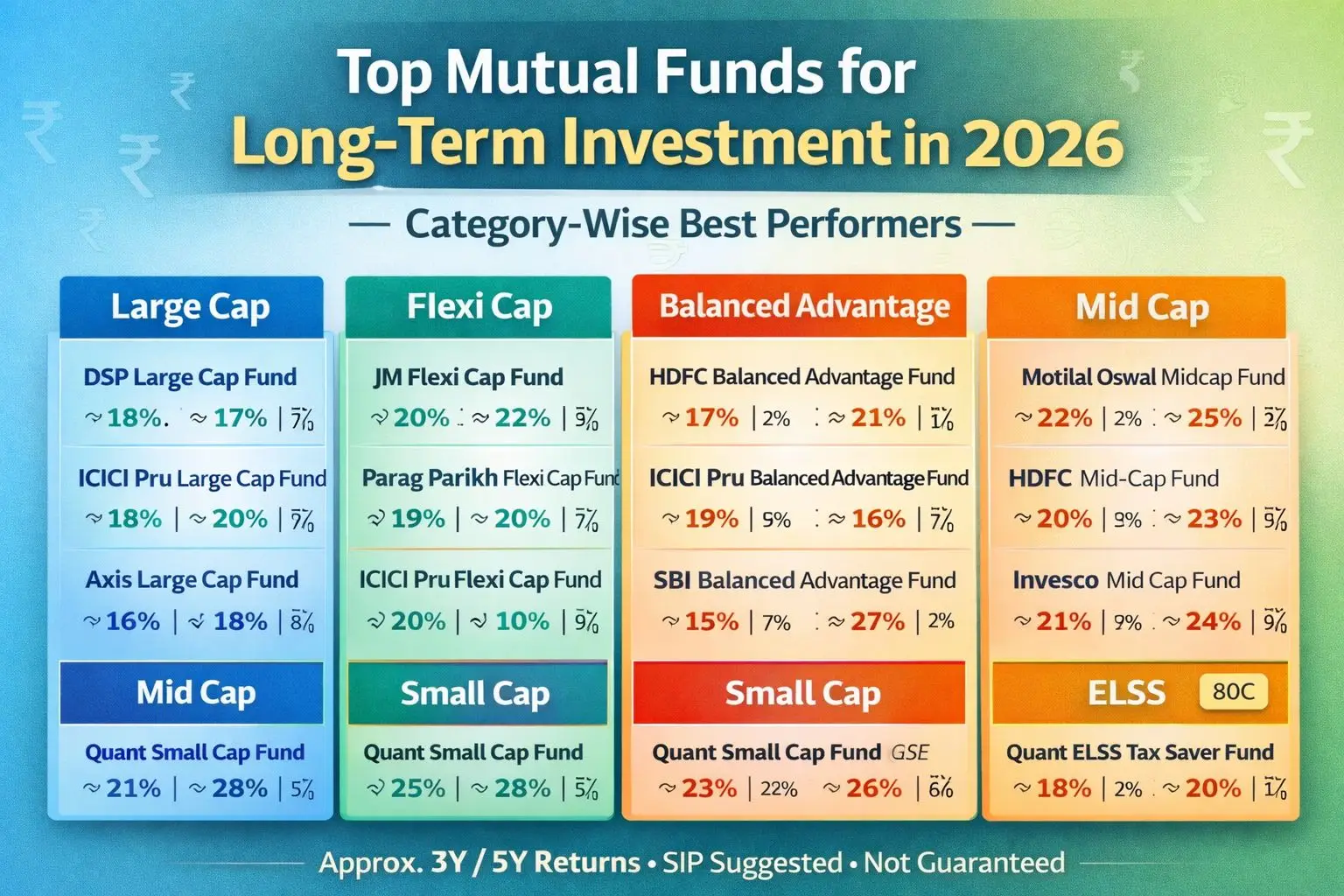

Choosing mutual funds only by past rankings is risky. In 2026, smart investors are selecting funds based on category strength, long-term consistency, and suitability to their risk level. Below is a clean, category-wise list of popular mutual funds, along with their approximate long-term annual returns, to help readers understand where each fund fits.

Important: Returns mentioned are past annualized averages, meant for learning purposes only. Mutual fund returns are market-linked and not guaranteed.

Large Cap Mutual Funds

(Stable companies, lower volatility, suitable for most investors)

| Mutual Fund | Fund Type | Avg. 3-Year Return | Avg. 5-Year Return | Risk Level |

| DSP Large Cap Fund | Large Cap Equity | 18% | 17% | Medium |

| ICICI Prudential Large Cap Fund | Large Cap Equity | 18% | 20% | Medium |

| Axis Large Cap Fund | Large Cap Equity | 16% | 18% | Medium |

| HDFC Large Cap Fund | Large Cap Equity | 15% | 17% | Medium |

Who should invest:

Long-term SIP investors, beginners, and those who prefer steady growth with controlled risk.

Suggested duration: 7 years or more.

Flexi Cap Mutual Funds

(Freedom to invest across large, mid, and small companies)

| Mutual Fund | Fund Type | Avg. 3-Year Return | Avg. 5-Year Return | Risk Level |

| JM Flexi Cap Fund | Flexi Cap Equity | 20% | 22% | Medium-High |

| Parag Parikh Flexi Cap Fund | Flexi Cap Equity | 19% | 20% | Medium |

| ICICI Prudential Flexi Cap Fund | Flexi Cap Equity | 20% | 19% | Medium-High |

| HDFC Flexi Cap Fund | Flexi Cap Equity | 18% | 21% | Medium |

Who should invest:

Investors who want one diversified equity fund that adapts to market changes.

Suggested duration: 7–12 years.

Balanced Advantage Funds

(Automatic balance between equity and debt)

| Mutual Fund | Fund Type | Avg. 3-Year Return | Avg. 5-Year Return | Risk Level |

| HDFC Balanced Advantage Fund | Balanced Advantage | 17% | 21% | Medium |

| ICICI Prudential Balanced Advantage Fund | Balanced Advantage | 16% | 18% | Medium |

| SBI Balanced Advantage Fund | Balanced Advantage | 15% | 17% | Medium |

| Axis Balanced Advantage Fund | Balanced Advantage | 14% | 16% | Low-Medium |

Who should invest:

Conservative investors, retirees, or people shifting from fixed deposits.

Suggested duration: 5–8 years.

Mid Cap Mutual Funds

(Faster-growing companies, higher ups and downs) Who should invest:

Investors with high risk tolerance and long investment horizons.

Suggested duration: 10 years or more.

Small Cap Mutual Funds

(Small companies with big potential, but high volatility)

| Mutual Fund | Fund Type | Avg. 3-Year Return | Avg. 5-Year Return | Risk Level |

| Quant Small Cap Fund | Small Cap Equity | 25% | 28% | Very High |

| Nippon India Small Cap Fund | Small Cap Equity | 23% | 26% | Very High |

| SBI Small Cap Fund | Small Cap Equity | 21% | 24% | Very High |

| Bandhan Small Cap Fund | Small Cap Equity | 20% | 23% | Very High |

Who should invest:

Young investors aiming for aggressive long-term wealth creation.

Suggested duration: 10–15 years.

ELSS (Tax-Saving Mutual Funds)

| Mutual Fund | Fund Type | Avg. 3-Year Return | Avg. 5-Year Return | Tax Benefit |

| Quant ELSS Tax Saver Fund | ELSS Equity | 21% | 24% | Section 80C |

| SBI ELSS Tax Saver Fund | ELSS Equity | 18% | 20% | Section 80C |

| Mirae Asset ELSS Fund | ELSS Equity | 17% | 19% | Section 80C |

| Canara Robeco ELSS Fund | ELSS Equity | 16% | 18% | Section 80C |

Who should invest:

Salaried individuals looking to save tax and grow wealth together.

Lock-in period: 3 years.

Important Note for Readers (You Can Add This)

- Do not invest only by seeing returns

- Always match the fund with your risk capacity

- Prefer SIP for long-term investing

- Review performance once a year, not daily

Disclaimer

Mutual fund investments are subject to market risks. Returns mentioned are based on historical performance and may change in the future. Please read scheme documents carefully or consult a SEBI-registered advisor before investing.