Planning for retirement is a crucial step toward securing your financial independence and maintaining a comfortable lifestyle. In India, there are several pension schemes available, including government-backed and private options, designed to cater to different income levels, risk preferences, and long-term financial goals. Here’s a comprehensive guide to some of the most widely used pension plans.

Why Pension Schemes Are Important

Investing in a pension plan comes with several key advantages:

- Financial Security: Pension plans provide a steady income stream after retirement, ensuring you can meet your daily expenses without worry.

- Tax Benefits: Contributions to many pension schemes are eligible for tax deductions, helping you save while you invest for the future.

- Flexibility: Certain plans allow partial withdrawals or the ability to change investment allocations, giving you more control over your retirement corpus.

- Peace of Mind: A well-planned pension reduces dependence on family or others and helps maintain your lifestyle even in later years.

How to Choose the Right Pension Plan

Selecting the right pension plan depends on several factors:

- Retirement Goals & Age: Assess how much income you’ll need after retirement and when you plan to retire.

- Risk Appetite: Government-backed schemes are typically low-risk, while market-linked plans may offer higher returns but with some volatility.

- Investment Horizon: The longer your investment period, the more you can benefit from equity exposure, which can enhance returns.

- Tax Considerations: Understand the tax benefits, contribution limits, and withdrawal rules for each scheme before investing.

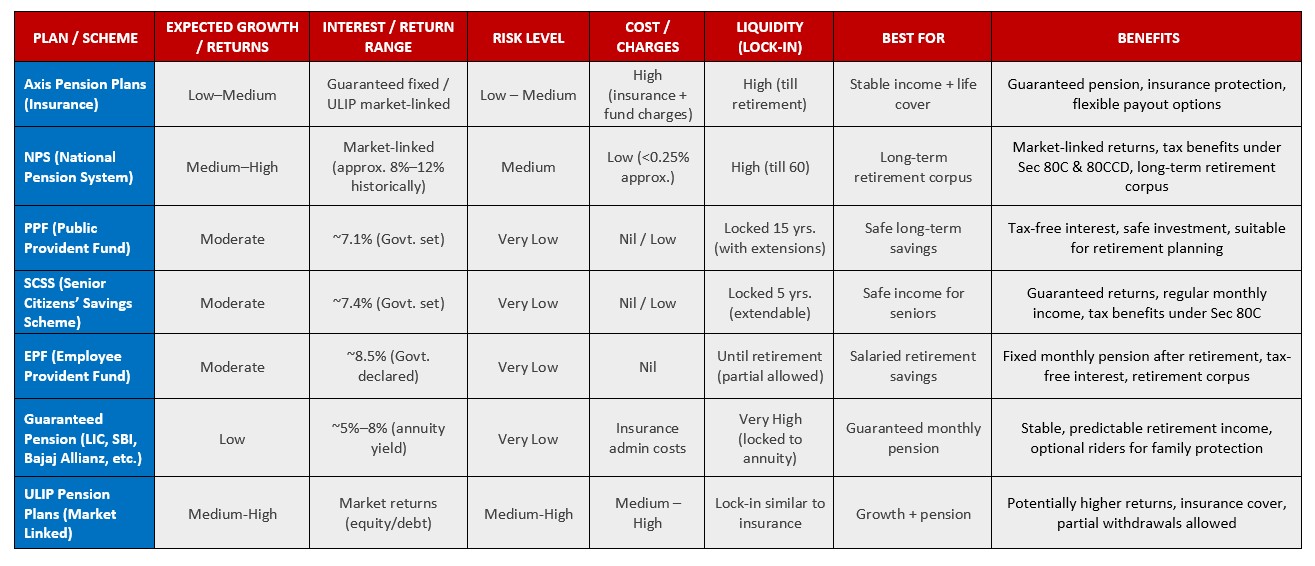

Most popular pension schemes mention below :-

Conclusion

Retirement planning is more than just saving money—it’s about creating financial stability and independence for your later years. By exploring and understanding the features of different pension schemes in India, you can make informed choices that match your financial goals and lifestyle. Starting early allows you to take advantage of compounding, helping you build a secure and worry-free retirement fund.